FINANCIAL MANAGEMENT

CHECK POINT 46: OPERATING BUDGET

This Check Point Is Available By Subscription Only,

But You Can Still Check Out The Menu Below. |

|

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

FINANCIAL MANAGEMENT

CHECK POINT 46: OPERATING BUDGET

Please Select Any Topic In Check Point 46 Below And Click. |

|

|

| |

|

DO I NEED TO KNOW THIS CHECK POINT?

|

| |

WELCOME TO CHECK POINT 46 |

|

| |

HOW CAN YOU BENEFIT FROM CHECK POINT 46? |

| |

| The main purpose of this check point is to provide you and your management team with detailed information about an Operating Budget and how to apply this information to maximize your company's performance. |

| |

| In this check point you will learn: |

| |

• What is a budget?

• About the advantages of a budgeting process.

• About the budgeting process questions.

• About the budgeting process parameters.

• About two main components of a master budget.

• About four elements of an operating budget.

• About three elements of a financial budget.

• How to prepare individual budgets and complete the master budget?

• About sales budgets and sales forecasts.

• How to complete a budgeting process in any company... and much more. |

| |

LEAN MANAGEMENT GUIDELINES FOR CHECK POINT 46 |

| |

| You and your management team should become familiar with the basic Lean Management principles, guidelines, and tools provided in this program and apply them appropriately to the content of this check point. |

| |

| You and your team should adhere to basic lean management guidelines on a continuous basis: |

| |

| • |

Treat your customers as the most important part of your business. |

| • |

Provide your customers with the best possible value of products and services. |

| • |

Meet your customers' requirements with a positive energy on a timely basis. |

| • |

Provide your customers with consistent and reliable after-sales service. |

| • |

Treat your customers, employees, suppliers, and business associates with genuine respect. |

| • |

Identify your company's operational weaknesses, non-value-added activities, and waste. |

| • |

Implement the process of continuous improvements on organization-wide basis. |

| • |

Eliminate or minimize your company's non-value-added activities and waste. |

| • |

Streamline your company's operational processes and maximize overall flow efficiency. |

| • |

Reduce your company's operational costs in all areas of business activities. |

| • |

Maximize the quality at the source of all operational processes and activities. |

| • |

Ensure regular evaluation of your employees' performance and required level of knowledge.

|

| • |

Implement fair compensation of your employees based on their overall performance.

|

| • |

Motivate your partners and employees to adhere to high ethical standards of behavior. |

| • |

Maximize safety for your customers, employees, suppliers, and business associates. |

| • |

Provide opportunities for a continuous professional growth of partners and employees. |

| • |

Pay attention to "how" positive results are achieved and constantly try to improve them. |

| • |

Cultivate long-term relationships with your customers, suppliers, employees, and business associates. |

|

|

|

1. WHAT IS A BUDGET? |

|

|

A BUDGET |

Business owners and managers must master the art and the science of the budgeting process, which represents one of the most important managerial responsibilities in every business organization.

The evaluation of financial statements provides management with essential information and assists throughout the Financial Planning Process. The main objective of this process is to prepare a set of plans, or budgets, for the forthcoming fiscal period.

In accounting terms, a Budget is defined as a comprehensive quantitative plan for utilizing the resources of the organization within a specified period of time. |

| |

ADDITIONAL INFORMATION ONLINE |

Please watch these excellent videos professionally narrated and produced by William Rae, Alumni Financial Services, and eHowFinance. |

|

© 2008 - 2013 William Rae, Alumni Financial Services, and eHowFinance. All rights reserved. |

|

|

2. ADVANTAGES OF THE BUDGETING PROCESS |

|

|

IMPORTANCE OF THE BUDGETING PROCESS |

The process of preparing a budget, or the Budgeting Process, is an integral part of the company's operational planning activities. The budgeting process is essential in maintaining an effective control of company activities and it has several important advantages outlined below. |

ADVANTAGES OF THE BUDGETING PROCESS |

1. |

Management ideas can be converted into specific tangible objectives and formal plans. |

2. |

Objectives and plans can be communicated throughout the organization to managers. |

3. |

Strategic and operational plans can be implemented efficiently to achieve organizational objectives. |

4. |

Coordination of operational activities within the organization can be improved. |

5. |

Effective management control is facilitated. |

|

| |

ADDITIONAL INFORMATION ONLINE |

|

|

|

3. BUDGETING PROCESS QUESTIONS |

|

|

THE BEGINNING OF THE BUDGETING PROCESS |

The Budgeting Process is one of the most important managerial responsibilities in every company. This process starts with an overall Business Evaluation of the company’s activities by top management in conjunction with establishing preliminary parameters for the company's financial performance. In conducting a business evaluation, managers should ask themselves a number of questions outlined below. |

THE BUDGETING PROCESS QUESTIONS |

1. |

What business are we really in? |

2. |

Do we have unique or valuable skills? |

3. |

Who are our customers and how do they view us? |

4. |

What is our position in the marketplace? |

5. |

Who are our competitors and how do they view us? |

6. |

What is our position in the industry? |

7. |

What are our major strengths and weaknesses? |

8. |

What should we do to improve the performance? |

9. |

Where do we want to be in one to five years from now? |

10. |

Do we have to incur additional capital expenditure? |

11. |

How can we finance our future development? |

12. |

What steps do we have to take to achieve our objectives? |

|

ADDITIONAL INFORMATION ONLINE |

Please watch these excellent videos professionally narrated and produced by William Rae, Alumni Financial Services, and eHowFinance. |

|

© 2008 - 2013 William Rae, Alumni Financial Services, and eHowFinance. All rights reserved. |

|

|

4. BUDGETING PROCESS PARAMETERS |

|

|

THE BUDGETING PERIOD |

Once the budgeting process questions are answered in a suitable manner, managers should establish appropriate Financial Objectives concerning company performance and proceed with the budgeting process.

Budgets are usually compiled for one fiscal year and then sub-divided into monthly periods, providing the necessary level of management control. Preparation of budgets entails taking into consideration several important parameters outlined below. |

THE BUDGETING PROCESS PARAMETERS |

1. |

Objectives.

What are the company's objectives which must be fulfilled? |

2. |

Activities.

What are the company's activities required for fulfilling those objectives? |

3. |

Resources.

What are the company's resources required in carrying out those activities? |

4. |

Costs.

What are the costs that the company will incur by using those resources? |

|

| |

The budgeting process can be completed manually or by using an accounting software program. |

| |

POPULAR ACCOUNTING SOFTWARE PROGRAMS |

| There are several excellent accounting software programs available to small business owners at present. Some of the most popular accounting software packages are presented below: |

| |

|

• Sage One

• QuickBooks Intuit

• FreshBooks

• Harvest Software Systems

• NetSuite

|

Various accounting software programs may include additional functions, depending on each specific package. This is discussed in detail in Integrated Financial Management in Tutorial 3. |

|

|

5. MASTER BUDGET |

|

|

MASTER BUDGET |

The final outcome of the budgeting process is a Master Budget which consists of two major components presented next. All individual elements of a master budget are strongly interrelated and must be prepared in a particular sequence. The formal relationship between these budgets and the sequence of their preparation is illustrated below. |

ELEMENTS OF A MASTER BUDGET |

|

|

|

| Operating Budget |

|

Financial Budget |

This is a financial plan that provides a description of a company's future operating results. It includes:

- Sales Budget.

- Production Or Operations Budget

(Cost Of Sales Budget).

- Operating Expenses Budget.

- Budgeted Income Statement.

|

|

This is a financial plan that provides a description of a company's future financial condition. It includes:

- Capital Expenditure Budget.

- Cash Budget

(Cash Flow Projection).

- Budgeted Balance Sheet.

|

|

|

| |

SEQUENCE OF PREPARATION OF INDIVIDUAL

COMPONENTS OF THE MASTER BUDGET |

|

|

The detailed Sequence Of Preparing Individual Budgets is outlined below. |

DETAILED SEQUENCE OF PREPARING INDIVIDUAL BUDGETS |

1. |

Sales Budget.

All sales projections related to the company's products and services should be summarized in the sales budget. |

2. |

Production Budget (Cost Of Sales Budget) For Manufacturing Companies.

All direct cost projections (material, labor, plant overhead, sub-contracting) in a manufacturing company should be summarized in the production budget. |

Operations Budget (Cost Of Sales Budget) For Non-Manufacturing Companies.

All direct material cost projections (cost of merchandise) in a merchandising company, or cost of direct materials, labor and sub-contracting in a project or contract management company should be summarized in the cost of sales budget. |

3. |

Operating Expenses Budget.

All operating cost projections should be summarized in the operating expense budget. These costs exclude all direct material, labor, and sub-contracting costs. Many small business owners incorporate the operating expenses budget into the cost of goods sold budget to create one operations budget. |

4. |

Budgeted Income Statement.

All projected values of income and expenses should be summarized in the budgeted income statement. |

5. |

Capital Expenditure Budget.

All projected values of capital expenditures should be summarized in the capital expenditure budget. |

6. |

Cash Budget (Cash Flow Projection).

All projected values of cash inflows and cash outflows should be summarized on a monthly basis in a cash budget or cash flow projection. |

7. |

Please watch these excellent videos professionally narrated and produced by Susan Crosson and SFCC: |

|

| |

ADDITIONAL INFORMATION ONLINE |

Please watch these excellent videos professionally narrated and produced by Susan Crosson and SFCC: |

|

© 2008 - 2013 Susan Crosson and CFCC. All rights reserved. |

|

|

6. SALES BUDGETING |

|

|

SALES BUDGET |

The Operating Budgeting Process starts with the preparation of a Sales Budget.

The sales budget must be prepared by the sales manager in accordance with realistic estimates of sales volume likely to be achieved during the forthcoming fiscal period. The main factors that usually influence the sales budgeting process are outlined below. |

FACTORS INFLUENCING THE SALES BUDGETING PROCESS |

1. |

Nature of the company's products and services. |

2. |

History of previous sales. |

3. |

Seasonal variations in product or service demand. |

4. |

The company's existing position in the marketplace. |

5. |

Influence by competitors. |

6. |

The company's plans for new product or service development. |

7. |

Expected product or service demand in the marketplace. |

8. |

Economic stability in the marketplace. |

9. |

Rate of inflation. |

|

| |

SALES FORECASTS |

As a result of detailed evaluation of these factors, the sales manager is expected to prepare accurate Sales Forecasts pertaining to all products or services offered by the company.

Sales forecasts are usually prepared for one fiscal year, thereby providing the first important parameter for the overall budgeting process. These forecasts provide quantitative estimates of the Level Of Sales, expressed in monetary terms, or units of product to be sold, or units of service to be rendered during the budgeted period.

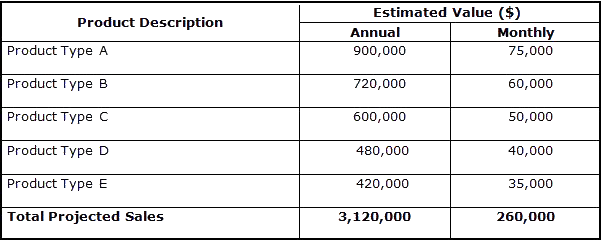

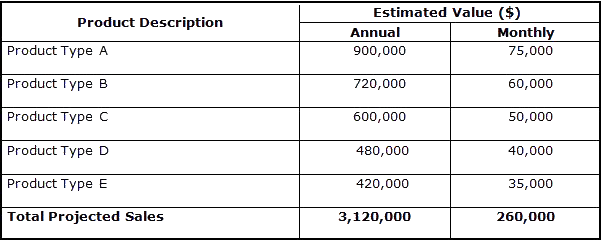

The complexity of a sales budget depends upon the range of products or services provided by the company. A simplified example of a company's sales budget is presented below.

Note:

Sales Forecasting is discussed in detail in Tutorial 5. |

|

|

7. SMALL BUSINESS EXAMPLE

SALES BUDGET |

|

|

SALES BUDGET |

Company Name: ABC Merchandising Company

The Budget Period: January 1, 2014 - December 31, 2014 |

|

|

|

8. PREPARATION OF SUPPORTING BUDGETS |

|

|

PREPARATION OF SUPPORTING BUDGETS |

The second stage in the operating budgeting process entails preparation of Supporting Budgets. Supporting budgets may differ depending upon the type of the company's operations illustrated below. |

TYPES OF A COMPANY'S OPERATIONS |

|

|

|

|

|

Service

Operations |

|

Merchandising

Operations |

|

Manufacturing

Operations |

|

|

|

|

9. THE BUDGETING PROCESS IN A SERVICE COMPANY |

|

|

SERVICE COMPANY |

A Service Company provides a range of specific services to customers and incurs certain operating expenses as a result of its activities.

The operating budgeting process in a service company entails preparation of Two Preliminary Budgets outlined below. |

TWO PRELIMINARY BUDGETS IN A SERVICE COMPANY |

1. |

Sales Budget.

This budget includes all sales projections, including allowance for discounts to customers during the budgeted period. |

2. |

Operating Expense Budget.

This budget includes estimates of all selling, service, and administrative costs, including net value of spare parts used during the budgeted period. |

|

The main steps related to the Operating Budgeting Process In A Service Company are summarized below. |

THE OPERATING BUDGETING PROCESS IN A SERVICE COMPANY |

Step 1: Prepare A Sales Budget.

Step 2: Prepare An Operating Expense Budget.

Step 3: Prepare A Budgeted Income Statement. |

| |

A BUDGETED INCOME STATEMENT FOR A SERVICE COMPANY |

Upon estimating all sales values and expenses, the Sales Budget should be integrated with the Operating Expense Budget into the Budgeted Income Statement.

A typical Budgeted Income Statement for a service company is presented below. |

|

|

|

10. SMALL BUSINESS EXAMPLE

BUDGETED INCOME STATEMENT FOR A SERVICE COMPANY |

|

|

BUDGETED INCOME STATEMENT FOR A SERVICE COMPANY |

Company Name: ABC Service Company

The Budget Period: January 1, 2014 - December 31, 2014 |

|

|

|

11. THE BUDGETING PROCESS IN A MERCHANDISING COMPANY |

|

|

MERCHANDISING COMPANY |

A Merchandising Company is engaged in buying and selling products to customers at a profit. This type of operation requires that the company carries a sufficient quantity of merchandise inventory in its stores.

In addition, the merchandising company incurs selling and administrative expenses as a result of its activities. Budgeting for a merchandising company applies equally to both types of merchandising businesses illustrated below. |

TWO TYPES OF MERCHANDISING COMPANIES |

|

|

|

Wholesale Companies |

|

Retail Companies |

Wholesalers are engaged in purchasing a narrow range of products in relatively large volumes for resale to retailers. |

|

Retailers are engaged in purchasing a broad range of products in much smaller volumes for resale to the general public. |

|

|

| |

THE BUDGETING PROCESS IN A MERCHANDISING COMPANY |

Depending upon the particular nature of your business, you may apply various elements of the merchandising budgeting procedures to meet your specific financial planning needs.

The operating budgeting process in a merchandising company entails preparation of Three Preliminary Budgets illustrated below. |

THREE PRELIMINARY BUDGETS IN A MERCHANDISING COMPANY |

1. |

Sales Budget.

This budget includes all sales projections, including allowance for merchandise returns and discounts to customers during the budgeted period. |

2. |

Cost Of Goods Sold Budget.

This budget includes the estimated net cost of merchandise purchases (gross cost of merchandise purchases less returns to suppliers and discounts received) and the difference between the estimated inventory values at the start and at the end of the budgeted period. |

3. |

Operating Expense Budget.

This budget includes all selling and administrative cost estimates during the budgeted period. |

|

As mentioned earlier, many small business owners incorporate the operating expenses budget into the cost of goods sold budget to create one operations budget.

The main steps related to the Operating Budgeting Process In A Merchandising Company are summarized below. These steps also apply to Project And Contract Management Companies. |

THE OPERATING BUDGETING PROCESS IN A MERCHANDISING COMPANY

(WHOLESALERS AND RETAILERS) |

Step 1: Prepare A Sales Budget.

Step 2: Prepare A Cost Of Goods Sold Budget.

Step 3: Prepare An Operating Expense Budget.

Step 4: Prepare A Budgeted Income Statement. |

| |

A BUDGETED INCOME STATEMENT FOR A MERCHANDISING COMPANY |

Upon estimating all sales values, expenses, and relevant inventory values, the Sales Budget should be integrated together with the Cost Of Goods Sold Budget and the Operating Expense Budget into the Budgeted Income Statement.

A typical Budgeted Income Statement for a merchandising company (wholesaler or retailer) is presented below. This type of statement also applies to project and contract management companies. |

|

|

|

12. SMALL BUSINESS EXAMPLE

BUDGETED INCOME STATEMENT FOR A MERCHANDISING COMPANY |

|

|

BUDGETED INCOME STATEMENT FOR A MERCHANDISING COMPANY |

Company Name: ABC Merchandising Company

The Budget Period: January 1, 2014 - December 31, 2014 |

|

|

|

13. THE BUDGETING PROCESS IN A MANUFACTURING COMPANY |

|

|

MANUFACTURING COMPANY |

A Manufacturing Company is engaged in converting raw materials into finished goods by means of utilizing labor, equipment, and production facility. This type of operation requires that the manufacturing company carries three different types of inventory illustrated below. |

THREE TYPES OF INVENTORY IN A MANUFACTURING COMPANY |

|

|

|

|

|

Raw Materials |

|

Work-In-Process |

|

Finished Goods |

|

|

Furthermore, the manufacturing company incurs manufacturing, selling, and administrative expenses as a result of its activities. Thus, the operating budgeting process for a manufacturing company entails preparation of Four Preliminary Budgets outlined below. |

FOUR PRELIMINARY BUDGETS IN A MANUFACTURING COMPANY |

1. |

Sales Budget.

This budget includes all sales projections, including allowance for returns and discounts to customers during the budgeted period. |

2. |

Production Budget.

This budget, also known as the Cost Of Goods Manufactured Budget, includes the estimated net cost of all direct (raw) materials purchases, direct labor, and sub-contracting service costs, total plant (see note below) overhead costs, and the difference between estimated inventory (raw materials and work-in-process) values at the start and at the end of the budgeted period. |

3. |

Cost Of Goods Sold Budget.

This budget incorporates the Cost Of Goods Manufactured Budget, described above, and the difference between estimated inventory (finished goods) values at the start and at the end of the budgeted period. |

4. |

Operating Expenses Budget.

This budget includes all selling and administrative cost estimates during the budgeted period. |

|

Note:

Plant is defined by Webster Dictionary is: "the tools, machinery, fixtures, buildings, grounds, etc., of a factory or business".

The main steps related to the Operating Budgeting Process In A Manufacturing Company are summarized below. |

THE BUDGETING PROCESS IN A MANUFACTURING COMPANY |

Step 1: Prepare A Sales Budget.

Step 2: Prepare A Production Budget.

Step 3: Prepare A Cost Of Goods Sold Budget.

Step 4: Prepare An Operating Expense Budget.

Step 5: Prepare A Budgeted Income Statement. |

|

|

|

14. PRODUCTION BUDGET |

|

|

PRODUCTION BUDGET |

The initial Production Budget is prepared by the production manager who is expected to be familiar with all information pertinent to his department.

A production budget should be prepared in collaboration with the sales manager in accordance with Sales Forecasts for the projected period. This budget entails estimating the cost of raw materials, labor, sub-contracting services, and plant overhead costs. Subsequently, all Manufacturing Costs should be accurately estimated and summarized in the production budget.

A typical production budget for a manufacturing company is presented below. |

ADDITIONAL INFORMATION ONLINE |

Please watch these practical videos about Production Budget narrated and produced by Tony Bell: |

|

© 2013 Tony Bell. All rights reserved. |

|

|

15. SMALL BUSINESS EXAMPLE

PRODUCTION BUDGET |

|

|

PRODUCTION BUDGET |

Company Name: ABC Manufacturing Company

The Budget Period: January 1, 2014 - December 31, 2014 |

|

BUDGETED INCOME STATEMENT FOR A MANUFACTURING COMPANY |

The value of the Cost Of Goods Manufactured, determined in the production budget above, must be transferred to the Budgeted Income Statement below to complete the budgeting process.

The preparation of the Budgeted Income Statement entails estimating the cost of goods sold and operating expenses. Upon estimating costs and relevant inventory values at the start and end of the budgeted period, all budgets must be integrated with the Sales Budget to prepare the Budgeted Incomes Statement.

A typical Budgeted Income Statement for a manufacturing company is presented below. |

|

|

16. SMALL BUSINESS EXAMPLE

BUDGETED INCOME STATEMENT FOR A MANUFACTURING COMPANY |

|

|

BUDGETED INCOME STATEMENT FOR A MANUFACTURING COMPANY |

Company Name: ABC Manufacturing Company

The Budget Period: January 1, 2014 - December 31, 2014 |

|

|

|

17. USE OF BUDGETS IN MANAGEMENT ACCOUNTING |

|

|

USE OF BUDGETS IN MANAGEMENT ACCOUNTING |

Once the operating budgeting process is completed, all estimated values specified in the budgeted income statement must be entered into the Management Accounting Reporting System.

Each Estimated Value of revenues, expenses, and income should be compared to the corresponding Actual Values on a monthly and year-to-date basis.

Doing so will enable management to determine Variances between budgeted and actual values, thereby identifying possible deviations from the original plan. Additional details pertaining to the use of the operating budgets as an important controlling device are provided later in Management Accounting in Tutorial 3. |

|

|

18. FOR SERIOUS BUSINESS OWNERS ONLY |

|

|

ARE YOU SERIOUS ABOUT YOUR BUSINESS TODAY? |

Reprinted with permission. |

|

19. THE LATEST INFORMATION ONLINE |

|

|

| |

LESSON FOR TODAY:

Good Budgeting Is A Uniform Distribution Of Dissatisfaction!

Joe Griffith

|

Go To The Next Open Check Point In This Promotion Program Online. |

| |

|